Protect Your Cattle: 3 Benefits of Having Livestock Risk Protection

Protect Your Cattle With Livestock Risk Protection

If you’re a cattle producer, buying crop insurance may not be something of which you think you qualify. Livestock Risk Protection (LRP) for Fed and Feeder Cattle are crop insurance products administered by the United States Department of Agriculture Risk Management Agency and is made specifically for cattle operations. Coverage is available for:

- Calves

- Steers

- Heifers

- Predominantly Brahman cattle

- Unborn calves

Producers submit a one-time application, at no cost, to ensure they are eligible to participate in the crop insurance program. (Some application determinations, like if you’re a beginning farmer or veteran, may affect your coverage decisions.)

After you are accepted, you select your coverage option by determining your breakeven point based on today’s market prices and select your length of coverage.

Below we discuss three benefits of having Livestock Risk Protection on your cattle operation.

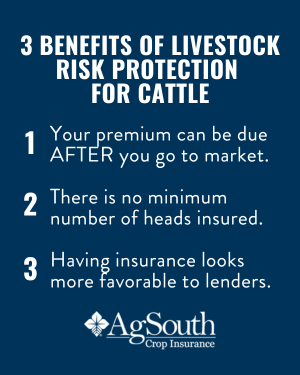

Your premium can be due AFTER you go to market.

After your application is approved, you can buy specific endorsements and coverage lengths anytime throughout the year to correspond when your cattle will go to market. Your premium is due the first day of the month following the end of your chosen endorsement period. If the national cash index is below your policy’s floor price at the end of your endorsement period, you get reimbursed the difference. This means that there is a potential for zero out-of-pocket expense if the loss is large enough to cover the premium and your loss.

There is no minimum number of heads insured.

Young, beginning, and small farmers tend to have less room for error on their balance sheet and a decline in market price could be detrimental to their operation and families. One of the biggest benefits of LRP is there is no minimum number of heads you must insure in order to apply for coverage. This is incredibly beneficial for smaller operations and part-time farmers who sell cattle on the side.

Having insurance on your operation looks favorable to lenders.

If your goal is to grow your operation, you might need to establish or expand your credit at some point. Having insurance on your cattle operation will look favorable to your lender on loan applications or line of credit requests, as they will know that you are already protected from losses.

More Resources:

USDA RMA LRP-Feeder Cattle Fact Sheet

USDA RMA LRP-Fed Cattle Fact Sheet

Ready to get started?

Unlike other insurance agents, AgSouth Crop Insurance agents are focused 100% on crop insurance policies and their farm customers. When asked about AgSouth Crop Insurance Brian Cook, an AgSouth Crop Insurance customer, stated, “[My agent] was very helpful in educating me on LRP and put rubber to the road in getting price protection on my calves in a timely manner. That’s important in my opinion – being able to promise, deliver, and follow through.”

If you are in Georgia, North Carolina or South Carolina and are interested in crop insurance, please contact us. Our agents are ready to guide you through the application process and beyond.