What is a Good Debt to Income Ratio and How to Calculate Yours

What is a Good Debt to Income Ratio and How to Calculate Yours

When getting a loan, one factor your lender is going to look at will be your debt to income ratio. Before you apply for a loan, you should know your ratio and how it might affect your loan approval or terms.

This article discusses the debt to income ratio for individuals - not business entities. If you are a farm business or a young, beginning, or small farmer looking for farm finance guidance, please visit here.

In this article:

- When a debt to income ratio is used

- Debt to income definition

- What is included in your debt to income ratio and how to calculate yours

- What is a good debt to income ratio

- How different interest rate environments affect what ratio your lender is looking for

- How to improve your debt to income ratio

When is a Debt to Income Ratio Used?

The debt to income ratio is used largely when getting a home or lot loan, but it can also help land buyers know their overall financial health before applying for a large acreage land loan.

“Land loans that are more than five acres are typically more risky to lend on than home loans in the eyes of a lender. Some land lenders will use other ratios in conjunction with debt to income to analyze your ability to repay the loan,” says AgSouth Farm Credit Credit Analyst Robby Williams.

Whether you are buying a home or land, knowing your debt to income ratio and where you fall will be a good indicator of your chances of getting approved.

Debt to Income Definition

Your debt to income ratio compares how much money comes in each month pre-tax verses how much money goes out to creditors or lenders for money you’ve already borrowed. It’s a ratio used to determine your capacity for taking on more debt.

What is a Good Debt to Income Ratio?

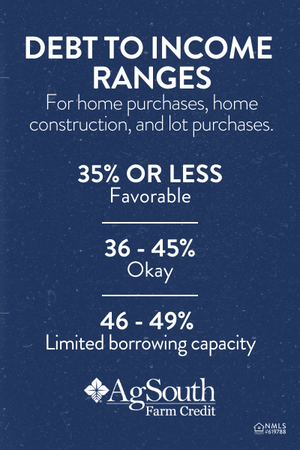

Different lenders and loan programs have varying requirement ranges for debt to income ratios. Before you get prequalified or apply for a loan, ask your lender what the debt to income requirement is for the loan product you are thinking of getting.

AgSouth Mortgages Home Loan Originator Brandt Stone says, “Typically, conventional home loan programs prefer a debt to income ratio of 45% or less but it’s not necessarily a hard stop as other factors can influence the decision (like loan to value and credit profile). FHA and VA loans will allow debt to income ratios above 45% as long as there are other positive factors. For USDA loans you must have a debt to income ratio of 41% or less. This is due to the loan to value being 100% (meaning, there is no down payment), therefore, the USDA wants to see a lower debt ratio since they are financing all of the purchase price.”

Typically, anything less than 35% will help get you a favorable interest rate and loan terms. Anything more than 45% means you have little to no extra spending money per month and might have a harder time being approved for credit.

What is Included in Your Debt to Income Ratio?

- Mortgage or rent payment including taxes and insurance

- Car payment(s)

- Student loan payment(s) - even if your payments have been deferred.

- Personal loan payments

- Minimum monthly credit card payment(s)

- Child support or alimony

- Any other debt that shows on your FICO credit report

How to Calculate Your Debt to Income Ratio

- Add up all of your monthly debts using the list above as a guide

- Divide that by your gross monthly pay (which is your pay before taxes and other deductions)

- Multiple that number by 100 to get a percentage

If you and your spouse are applying for a loan together, you would combine your monthly debts and income.

How High Interest Rate Environments Affect Debt to Income Ratio Requirements

“When interest rates rise, the monthly payment for your loan is higher than compared to the payment with a lower rate, therefore, you will qualify for less of a mortgage. This is something to keep in mind when interest rates are rising, especially if your debt to income ratio is in the higher range. Rising rates may decrease what you qualify for,” says Stone.

How to Improve Your Debt to Income Ratio

You can lower your debt to income ratio by:

- Consolidating higher interest rate debt to a lower interest rate. This would lower your monthly payment and decrease your debt-to-income ratio.

- You might want to consider paying off some debt to lower your ratio if possible. Keep in mind the down payment requirement for the loan you are considering and make sure you still have enough cash reserves to meet that requirement as well.

- If you are able to, increasing your gross monthly income will lower your ratio.

It’s important to know that even if you have a higher debt to income, that doesn’t mean you won’t get approved for a loan. Debt to income is just one piece of the puzzle used to qualify you as a borrower. Each loan program has its own credit guidelines, so it’s important to have an open line of communication with your lender.

(Read what else lenders look for in Understanding the 5 C’s of Credit.)

“We want to do what is best for you, both now and long term. The more information we know, the more we can help find a product that will work best for you and your budget”, says Stone. “If you don’t qualify for the loan type that is best for you at the time, we will help navigate you through your options for getting qualified. These may include ways to improve your credit profile or decrease your debt to income ratio so that you will qualify.”

Questions?

If you’re interested in buying land in South Carolina, North Carolina, or Georgia, one of our local loan officers would be more than happy to help. Find an AgSouth Branch near you!

Not in South Carolina, North Carolina, or Georgia? Find your Farm Credit Association.