Understanding Farm Financials Part 2

Whether you’re coming back to the family farm or starting up your own operation, understanding the business side of farming can be hard. In part 1, we discussed balance sheets, income statements, and cash flow. In this article, we talk about the ratios that tell the story of how financially healthy your farm is.

In this article, you'll analyze your:

- Working Capital

- Current Ratio

- Equity

- Liquidity

- Profitability

- Efficiency

In part 1, we discussed balance sheets, income statements, and cash flow. In this article, we talk about the ratios that tell the story of how financially healthy your farm is. If you haven’t read part 1 yet, click here.

Part 2: Know Your Numbers

While farming is a risky business, identifying production and financial projections are an important management skill. Farmers do have resources to help determine these values. Think about it this way, what amounts should I invest in acreage to be farmed or livestock to be purchased, raised or sold? Or what amounts will I receive for the sale of farm products? Remember these are projections, do your best to make them realistic. We encourage meeting with your loan officer to help walk you through this conversation and to help interpret what the ratios and benchmarks mean to your individual operation.

As an owner-operator it is important to keep accurate financial and production records for your operation -this will enable you to calculate these projections for the future. The first step is knowing where you are today so you can plan for the future!

Want to get a read on the health of your own operation? Download the [Farm Balance Sheet & Income Statement] spreadsheet to put in your own financial information.

Download & Edit: Farm Balance Sheet & Income Statement

Farm Financial Ratios and Benchmarks

Financial ratios will tell you how one particular aspect of your operation relates to another in the form of assets and liabilities. You can use these ratios to compare yourself to industry specific benchmarks to measure your performance against the competition and rest of the industry’s producers.

What is Working Capital?

Working Capital = Total Current Assets –Total Current Liabilities

Working capital is the money available to fund a business’s day-to-day operations. Positive working capital indicates the business can pay off its short-term liabilities almost immediately. For your operation, this might look like $/acre or $/cow.

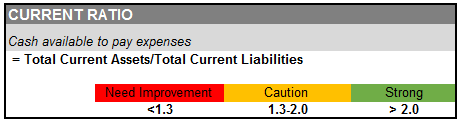

What is Your Current Ratio?

Ideally as an owner/operator you aim to have a minimum of a 1:1 ratio. This means that you have enough cash, or assets that will soon convert to cash, available to pay all of your expenses and bills for the reported period or year. This ratio allows you to see that you have adequate cash and items that will become cash available to service every $1 of debt payments and bills due.

For example, if you have $200,000 in assets and $130,000 in liabilities, your current ratio is 1.54. That means that for every $1 you owe of current debt, you have $1.54 in current assets to pay with.

*Depending on what industry you are involved with these benchmarks could change.

What are ways to improve your Current Ratio?

If your current ratio and working capital need improvement, consider selling capital assets such as equipment that are not generating return to the business. This will allow you to generate some cash that can be used to reduce current liabilities or debts.

Consider retaining net farm profits as cash to improve your ability to cover current liabilities. Net farm profits can also be used to reduce current liabilities or other liabilities by making payments to reduce debt. Before using profits or cash generated from selling equipment to invest in intermediate or long term assets (ex. land or equipment purchases), make sure that you have sufficient assets to cover your short term payments.

If your farm operating loan is close to the maximum principal level, or if your farm has carryover operating debt from the previous year, consider refinancing some of the farm operating debt with longer term financing.

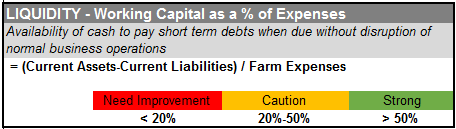

Liquidity

Essentially your liquidity with tells you how much of the year’s expenses you can pay with the liquid funds available for daily operations. Can you cash flow? Keep in mind the ratio assumes that all current liabilities (debt payments due in 12 month) are maintained and focuses primarily on the funds available for day to day operations and business expenses.

Both the current ratio and working capital ratio are measures of liquidity. Liquidity is the ability of the business to meet financial obligations as they come due. It is defined as the availability of cash or near-cash assets to cover short-term obligations without disrupting normal business operations. A good ratio to calculate to reflect liquidity is working capital as a percentage of annual expenses.

- 20%-50% - The reason you would want to monitor your financials closely if you fall within this range is because this ratio tells you that you will only be able to maintain 20-50% of your annual farm expenses with the funds that you currently have available for daily operations.

- >50% - Depending on your industry and personal risk tolerance it can be assumed that if you fall above 50% for this ratio you are in a comfortable position because you are able to maintain over half of your annual farm expenses with the funds that you currently have available for daily operations.

*Depending on what industry you are involved with these benchmarks could change.

What are ways to improve your Liquidity?

Improving liquidity can be a difficult task. It takes either A. time to build cash reserves, or B. the sale of assets with equity that are not needed in the operation.

The best way to improve liquidity is to run a lean, profitable operation and retain net farm profits as cash. In retaining net farm income as cash you are forgoing using these funds for asset purchases, debt reduction or other investments. This method, depending on the amount of net farm income, can take time.

A speedier method to improve liquidity is to sell assets with equity that are not used or vital to the operation. A common source of generating cash is selling old equipment. Harrows, planters, sprayers and tractors that sit idle and are not used in the operation and sit idle could be sold for cash to improve liquidity.

A final source of liquidity would be borrowed funds. Operating loans are a common source of borrowed funds that increases liquidity for producers. However, borrowing money on long terms simply to hold cash is not advisable, as it has severe implications for debt service and equity.

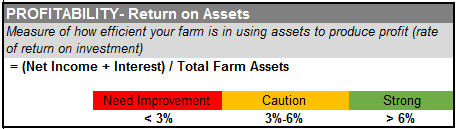

Profitability

This ratio is important because it can help a business owner decide whether or not their assets are making money. Do you currently own assets, equipment, vehicles, or livestock that aren’t making you any money? If so, what do you own of these assets and is there an opportunity to put your business in a better position by using those assets in another way to potentially liquidate them? The Return on Assets (ROA) shows the percentage of how profitable a farm’s assets are in generating revenue.

The ratio to determine ROA is:

*Depending on what industry you are involved with these benchmarks could change.

What are ways to improve your Profitability?

The best way to improve profitability is to have a solid understanding of your operation’s finances. While there is benefit to seeing your operation from a birds’ eye view, to truly maximize profitability you must understand your operation’s finances to the acre or per head of livestock.

To improve profitability, both income and expenses should be considered. To truly be profitable, each commodity produced and field/farm cultivated should pull its own weight in yields and profit. When analyzing profitability, calculate your costs AND income per acre and per farm.

Ask yourself questions like these:

- Am I leasing cultivated lands that are under-producing for yields?

- Are there other varieties or crops I could plant that would have higher yields on this particular farm/field?

- Should I consult a commodity expert to maximize my pricing on products?

- What could I do to A. increase yields on this farm or B. reduce costs without losing yield to improve profit?

- Am I overpaying for land rent?

- Are there less expensive sources of livestock feed such as through a cooperative?

Understanding how every dollar spent impacts final yield and dollars made on a by-acre, field, or head basis is crucial to improving profitability. That does not mean that every field or acre will have the same profitability. However, to improve your overall finance situation, the performance of each farm, field, or head of livestock must be considered.

All decisions must be made with careful financial consideration. For example, will the application of additional fertilizer improve yields, and ultimately profit, enough to justify the cost of the application? In another instance, taking on additional acres simply to increase revenues is not wise if the additional acres will not yield a harvest that makes profit over the dollars spent to grow the crop on those acres. This includes considering fixed costs such as additional machinery that many be needed to support the added acres.

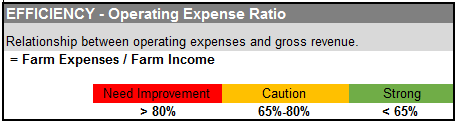

Efficiency

Efficiency is used to measure how much money you are able to make over your farm expenses. An operation hopefully sees that they pay back all their expenses, and make some money on top of that. To measure efficiency, the Operating Expense Ratio (OER) can be used to show the relationship between operating expenses and gross revenue.

This is calculated with the following formula:

*Depending on what industry you are involved with these benchmarks could change.

What are ways to improve your Efficiency?

Improving efficiency should be treated in the same manner as profitability. Efficiency is essentially a specific measure of profitability.

Questions?

We hope this information is helpful in helping you understand your farm finances. If you're looking to purchase land, farms or homes in Georgia, North Carolina, or South Carolina and have questions about the loan application process one of our loan officers would me more than happy to help. Find an AgSouth Branch near you!

Not in Georgia, North Carolina, or South Carolina? Find your Farm Credit Association.