Farm Income Statement Explained: How to Measure Profitability on Your Farm

A farm income statement shows whether your operation is truly profitable by listing all farm income, farm expenses, gross margin, fixed costs, and net income for the year. This guide explains each part clearly so full-time farmers and beginning farmers can understand their financial performance and make better decisions.

Who This Guide Is For

This guide is written for full-time farmers, part-time farmers, and beginning farmers who want to understand their farm financials, improve profitability, or prepare statements for a farm loan or operating line.

Understanding the Farm Income Statement: Measuring Your Operation’s Profitability

When it comes to managing your farm finances, understanding your income statement is key. While the balance sheet gives you a snapshot of your financial position, the income statement tells the story of your farm’s profitability over time.

What Is a Farm Income Statement?

A farm income statement (sometimes called a profit and loss statement) is one of the most important financial tools for your agricultural business. It shows how much money your farm earned, how much it spent, and whether the operation made a profit over a specific period—typically a year.

Five Essential Components of a Farm Income Statement

Farm Income

Farm income refers to the money coming into your operation from the sale of products and services. It represents the total earnings from your operation’s core activities. This typically includes:

- Livestock sales

- Crop sales

- Government payments

- Patronage income

- Other farm-related revenue

The total amount of income that comes into the farm operation in a given year does not indicate whether the operation was profitable. Profitability is only revealed once expenses are subtracted.

Farm Operating Expenses

Farm expenses are the costs associated with producing crops or raising livestock. These include:

- Labor and payroll

- Seed and feed

- Fertilizer and chemicals

- Land rent

- Fuel

- Veterinary care and medications

- Breeding fees

- Production supplies

These are the variable costs that fluctuate with the level of production such as number of acres or head of livestock. For example, every acre planted requires seed, therefore the total expense for seeds is variable, or depends, on the total number of acres.

Gross Margin (Gross Profit)

Gross margin, also referred to as gross profit, is the profit or loss from that year’s crop or livestock production.

Formula: farm income – variable expenses

Gross margin does not include fixed costs. A healthy gross margin is necessary to cover the operation’s overhead and ensure long-term sustainability.

Fixed Costs (Farm Overhead)

Fixed costs are expenses that occur regardless of production levels, such as:

- Owner or manager salary

- Family living expenses (if paid through the business)

- Equipment depreciation

- Interest

- Repairs and maintenance

- Property taxes

- Insurance

- Utilities

- Marketing or professional services

These costs remain stable and must be covered by gross margin for the farm to be profitable.

Net Farm Income (Farm Profit)

Net farm income is the final measure of your profitability.

Formula: gross income – (variable expenses + fixed expenses)

Net income shows whether your farm generated enough revenue to cover all costs for the year and indicates overall financial success.

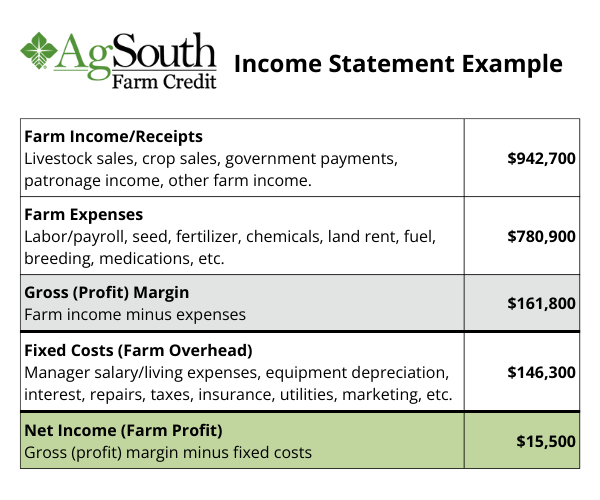

Farm Income Statement Example

Why the Farm Income Statement Matters

Your income statement offers a clear view of your farm’s financial performance. It helps you see:

- Whether your operation is profitable

- Whether expenses are growing faster than income

- Whether your pricing, yields, or herd management are sustainable

- Where you may need to adjust costs or investment

This insight is essential for making decisions about budgeting, expansion, or cost control. Lenders also rely on your income statement to assess your ability to repay loans and manage your business effectively.

How to Prepare Your Farm Income Statement

Gather Your Numbers

Collect all income and expense data from farm records, receipts, invoices, spreadsheets, or accounting software.

Organize by Category

Separate income items from expenses, then split expenses into:

- Variable (direct) costs – seed, feed, fertilizer, chemicals, etc.

- Fixed (overhead) costs – insurance, utilities, depreciation, etc.

Calculate Key Figures

- Gross profit margin = income – variable costs

- Net farm income = gross margin – fixed costs

Review With Your Lender or Advisor

Bring your income statement and updated balance sheet for a complete financial picture of your farm.

Download the Farm Income Statement Template (Excel)

Take the guess work out of tracking your numbers. Use this free Excel farm income statement template to organize income, expenses, and net farm income for your operation. Perfect for full-time farmers, small farmers or beginning farmers.

Download Farm Income Statement Template

Tips for Managing Your Farm Income Statement

To get the most value from your income statement:

- Keep detailed, organized records year-round

- Categorize income and expenses consistently

- Review financials regularly to identify trends

- Work with an advisor to track depreciation and interest correctly

- Use the same reporting format each year for easier comparisons

Common Mistakes Farmers Make

These are common issues that can distort financial performance:

- Mixing personal and business expenses

- Not recording depreciation

- Underestimating fixed costs

- Only reviewing financials at year-end

- Reporting income inconsistently

- Not keeping accurate receipts or records

Frequently Asked Questions

What is a farm income statement used for?

It measures farm profitability by showing income, expenses, and net income for the year.

How often should farmers prepare an income statement?

Annually is standard, but quarterly or monthly statements offer better insight and help with decision-making.

Is net farm income the same as cash flow?

No. Net income measures profitability; cash flow tracks the actual movement of money in and out of the operation.

Why do lenders request farm income statements?

They use them to evaluate repayment capacity, financial management, and the overall strength of your operation.

What This Means For Your Farm

Understanding the farm income statement is essential for managing your operation like a business. When used with your balance sheet and cash flow statement, it gives you a full view of your financial health.

By learning each component, you can make more informed decisions, improve profitability, and build a stronger, more resilient farm.